If you feel intimidated by the world of finance, you’re not alone. According to a study

by Ally Invest, 61% of adults say they find investing in the stock market scary or intimidating. And in a report by investing app Acorns, 68% of people said they’d rather discuss their weight than talk money.

But Tina Hay has a solution: fitting everything you need to know about finance on a cocktail napkin. Her company, Napkin Finance, helps people understand money concepts in 30 seconds or less, using visual diagrams.

The idea came to Hay when she was studying at Harvard Business School. As someone with a liberal arts background, Hay struggled to keep up with people with more traditional finance and business educations.

“I’m a visual learner, as most people are, and I found that illustrations and sketching really helped me understand topics,” she says.

Now, Napkin Finance, which launched in 2015, has grown to include a library of financial terms and topics, including taxes, investing, retirement planning, and entrepreneurship. Hay believes understanding the basics can lead people to a lifetime of financial health.

“Knowledge is power and we look at financial literacy as an opportunity for women and men to really take control of their future,” Hay says.

Hay helps explain three basic financial topics using napkins:

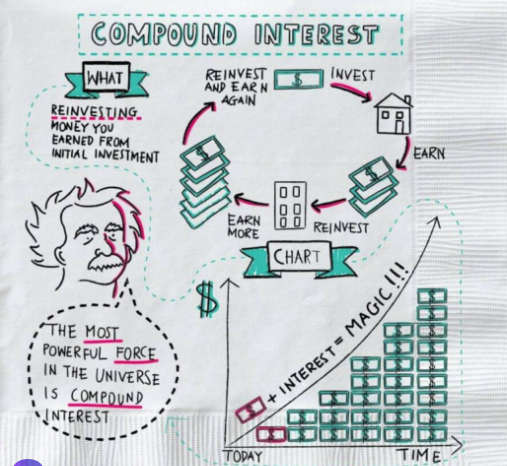

Compound interest:

Compound interest is reinvesting money you earn off of your initial investment. As you invest your money, you’ll earn money on your investment through interest. If you continue to invest more money, the interest will compound.

“It’s money on top of money,” Hay says.

Your money will quickly grow and multiply, leading to what experts call the magic of compound interest. The longer you invest, the more your money will grow.

Bull and bear markets:

Understanding how the stock market works can seem intimidating, but mastering some basic terms will help you get a handle on the ups and down of the market, Hay says.

Bull and bear markets are general descriptions for how the stock market is doing: during a bull market, stocks are rising, the economy is growing, and unemployment is falling or stable. The reverse is a bear market, where stocks are falling and unemployment numbers are rising.

“It’s important to understand the way the market works and how to respond during those cycles,” Hay says.

Retirement accounts:

IRAs and 401(k)s are vital ways to invest and save for retirement, but understanding the difference leaves many people confused. An IRA is an individual retirement account, where the individual sets up their account and invests funds.

A 401(k) is an employer-sponsored account, where the employer sets up the account and then the employee contributes a percentage of their paycheck to the account, which is often matched by their employer.

While the two accounts are different, Hay explains both options are good for long-term saving.

“Both IRAs and 401(k)s help you accumulate money and save for retirement, they both help you defer taxes and they both help build your wealth,” Hay explains. “It’s a great opportunity to save for the long term.”

This article originally published on Finance.Yahoo.com by Alyssa Pry